Big Tech Stock Prices

INFO 526 - Spring 2024 - Project 1

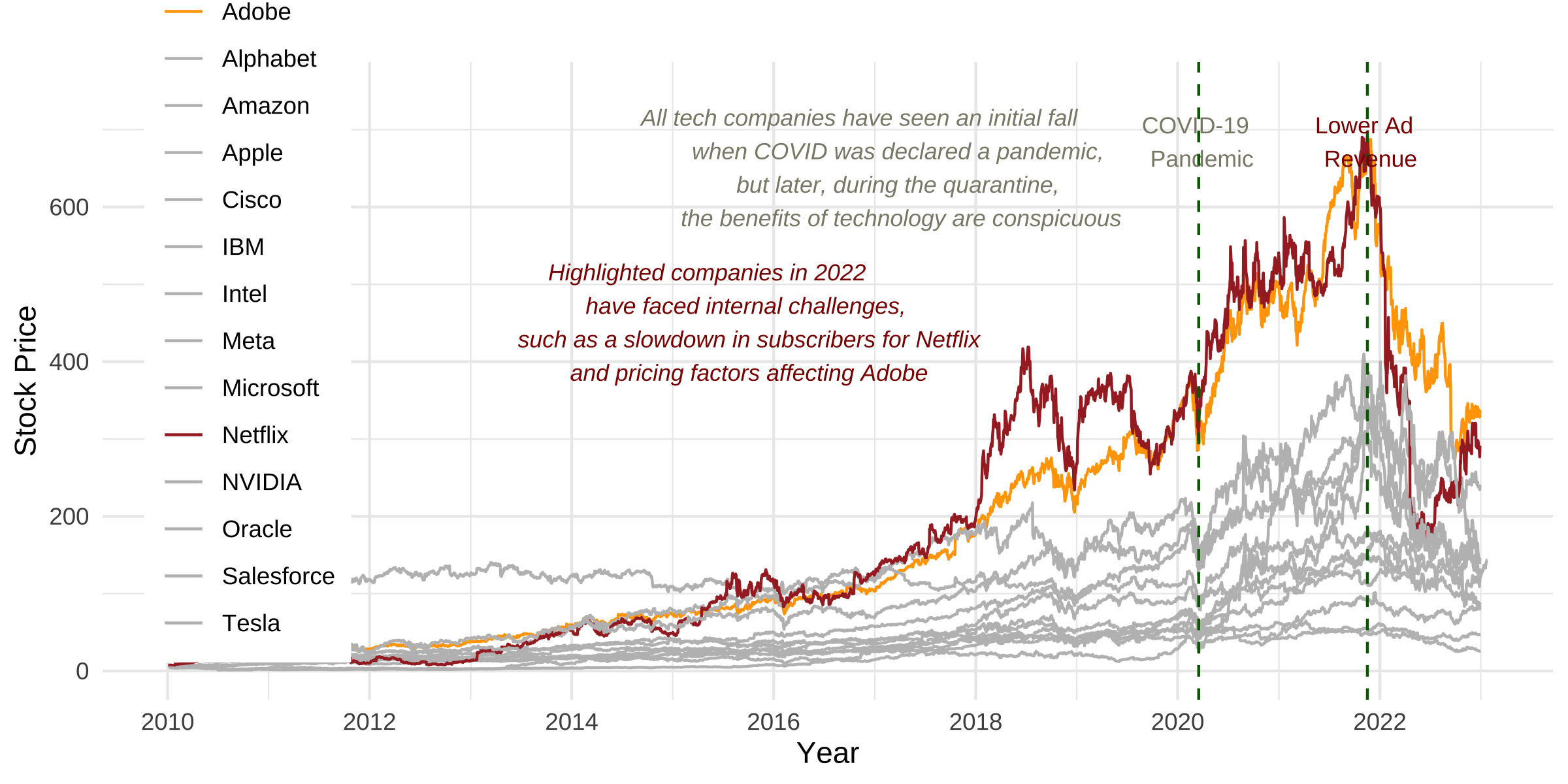

The Rise and Fall: Historical Patterns in Big Tech Stock Prices

Data Description

Big Tech Stock Price&Big Tech Companiesdatasets from tidytuesday.- Includes

open,close,high,lowandadj_closeprices for company. - Data spans from 2010 to 2022, allowing for in-depth analysis and trends.

- Our Data:

big_tech_companiesdatasetbig_tech_stock_pricesdataset

Objective

- Delving into the performance of 14 leading tech companies, with a focus on understanding the influence of COVID-19.

- Question 1: Which companies have experienced the highest/lowest impact on their stock prices due to the pandemic?

- Question 2: What patterns do we see in the positive gain days over the given period?

Question 1

Which companies have experienced the highest/lowest impact on their stock prices due to the pandemic?

Plot1

Depicts trends for all 14 companies using

geom_lineAnnotates with the COVID-19 period.

Highlights notable trends of Adobe and Netflix with distinct line colors.

Includes comments for better understanding.

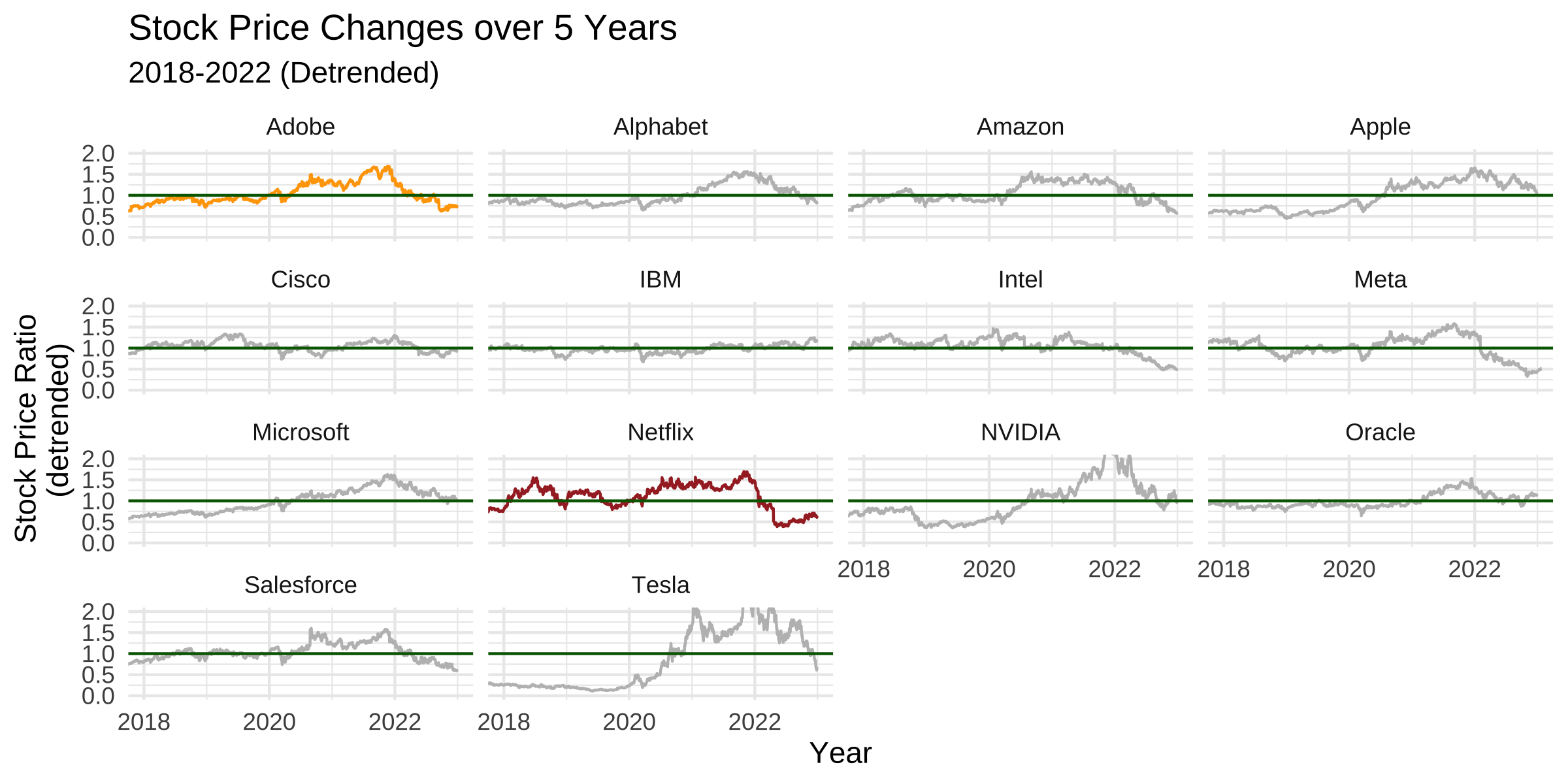

Plot2

Zooms into the period from 2018 to 2022.

Utilizes de-trending days plot based on 14

linear models.Ratios calculated for insights on a standardized scale and plotted using

geom_lineFacets maintain color patterns from the first plot.

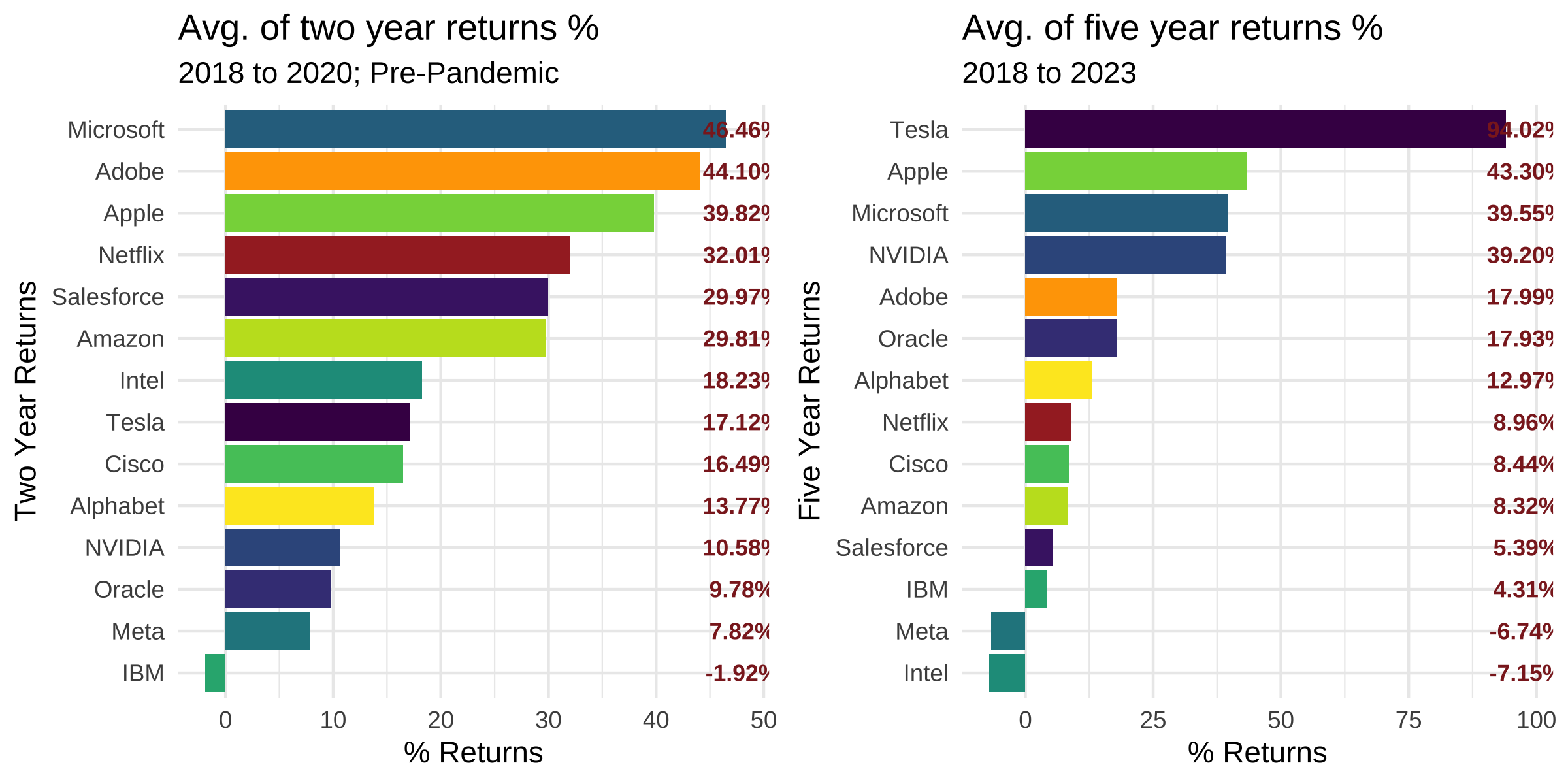

Plot3

Focuses on starting date (2018), 2020, and closing date (2022).

Extracts two-year and five-year returns for all companies and calculates average returns for all companies

Bar plotfor descending two-year returns and five-year returns are plotted and then combined usingcowplot

Impact of Stock Prices around COVID-19

Discussion

- Pandemic Impact on Winners and Losers (2022):

- Netflix and Adobe experienced significant declines.

- Factors: post-Covid-19 effects, sales slowdown, recession fears, internal issues, rising unemployment. Apple, Microsoft, and IBM showed resilience in 2022.

- Long-Term Trends (Overall):

- Apple, Tesla, and Microsoft emerged as standout gainers.

- Tesla recorded the highest 5-year returns, surging from 17% to an impressive 94%.

Question 2:

What patterns do we see in the positive gain days over the given period?

Plot1:

- Illustrate overall

gain-daysof all companies from 2010 to 2022 on a yearly basis. - Animated series of 12

columncharts representing different companies. - Dynamic presentation reveals peaks and troughs of gain days across these years and utilizes

geom_textto annotate the number of gain days for swift comprehension.

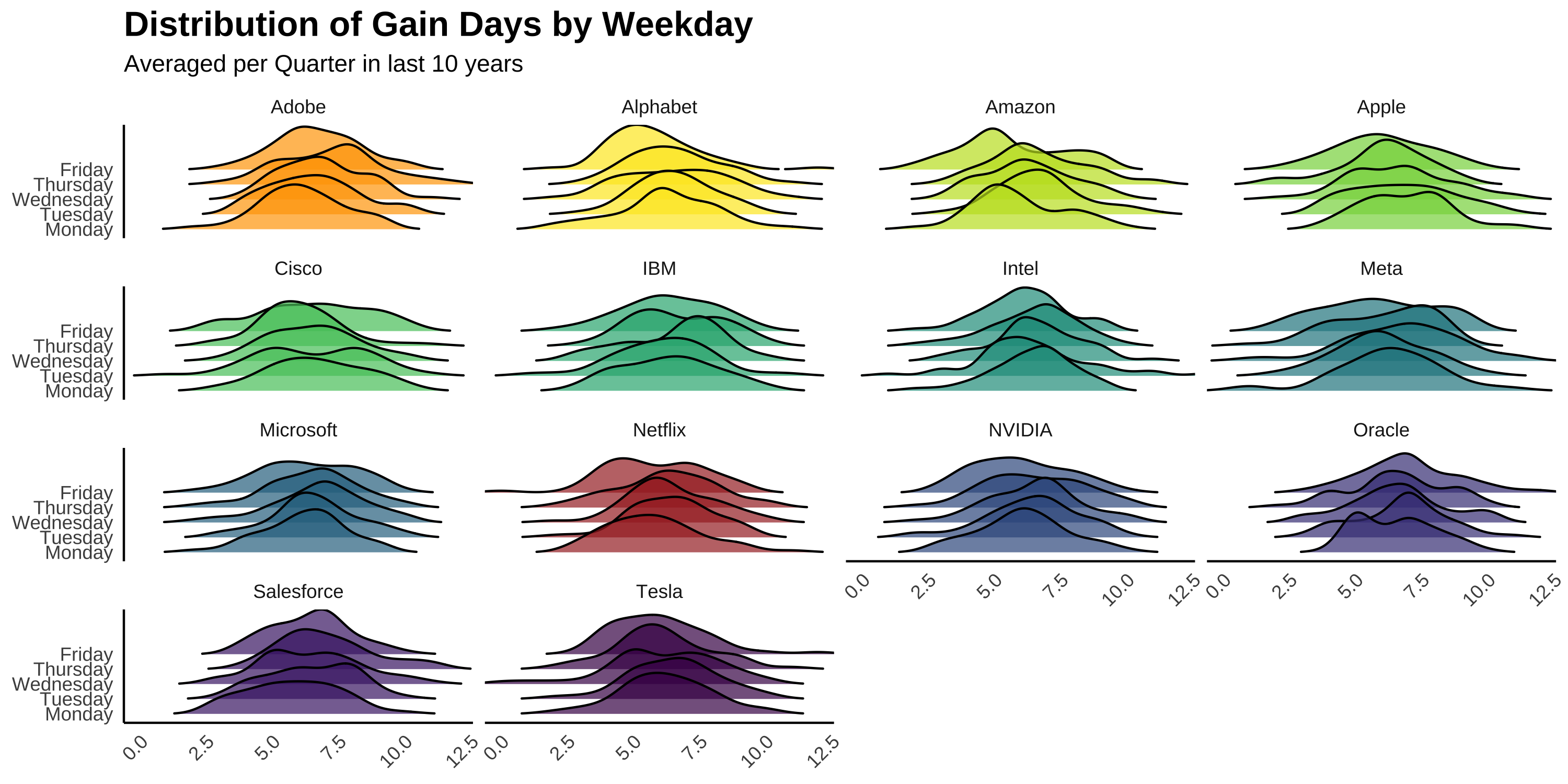

Plot2:

- Provide a deeper understanding of trading dynamics based on gain-days.

- Gain-days grouped by quarter and weekday and averages of approximately 12 weekdays per quarter for consistency.

Ridge densityplots visually articulate the spread and peaks of gains across weekdays.- Facilitates identification of specific days more favorable for trading in the context of individual tech companies.

+Ve Gain Days Trading Strategies

Discussion

- Leveraging Positive Gain Days:

- Examining positive gain days across weekdays.

- Short-term investors can strategically align with historical performance.

- Optimizing Trading Strategies:

- Incorporates return patterns and positive gain day distributions.

- Empowers traders with insights for effective day and weekly strategies.

- Graphs serve as valuable tools in the dynamic stock market landscape.